Short Term Cash

Short-term cash trading refers to the strategy of buying and selling stocks within a relatively short period, often days, weeks, or even hours, to capitalize on price movements. Unlike long-term investing, which involves holding stocks for years to benefit from gradual appreciation and dividends, short-term trading seeks quicker profits from fluctuations in stock prices. This approach requires a strong understanding of technical indicators, market trends, and price patterns since short-term traders rely heavily on timing the market to maximize gains and minimize losses.

To be successful in short-term trading, traders employ various strategies, including day trading, swing trading, and momentum trading. Day trading involves buying and selling stocks within a single trading day, aiming to profit from intraday price movements. Swing trading, on the other hand, focuses on capturing gains over a few days to several weeks by riding market swings. Momentum trading capitalizes on stocks showing strong trends, buying them as they rise and selling once the momentum begins to fade. Each of these methods requires careful analysis and the use of tools like candlestick charts, moving averages, and relative strength index (RSI) to make informed decisions.

While short-term trading can yield substantial returns, it also comes with significant risks. Market volatility can lead to rapid price changes, which can result in quick losses if trades are not managed carefully. Short-term traders must often deal with high transaction costs due to frequent buying and selling, which can erode profits over time. Additionally, they need a solid risk management strategy, including setting stop-loss and take-profit levels, to avoid excessive losses and protect their capital.

In general, short-term trading is best suited for those who have a deep understanding of the stock market, a high tolerance for risk, and the time to monitor markets consistently. It is an active trading style that demands discipline, quick decision-making, and adaptability to shifting market conditions. For beginners, it is often recommended to practice with virtual trading accounts or paper trading before committing real capital, as short-term trading can be highly challenging without proper experience and knowledge.

Short Term Cash

A short-term cash is a security purchased with the intention of selling within a short period, typically a few days to months, aiming for quick gains from market fluctuations.

Risk & Rewards

Will be better than 1:2

Our services features & what we serve to our clients.

- 1. Expected number of quality recommendations is 15-20 per month.

- 2. We will provide stop loss and target with regular followup.

- 3. Minimum capital requirement – 3,00,000 INR.

- 1. Timely Global market and Economic data update.

- 2. Method – Technical breakout with volume and price level.

- 3. Customer support – 9:00 AM to 6:30 PM (Mon – Sat).

- 1. All important news and economy updates.

- 2. Proper follow up through SMS.

- 3. Complete Resistance & Support on daily basis.

- 4. All Segment Calls from NISM Certified.

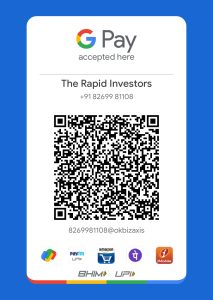

The Rapid Investors

important to approach it with caution and a long-term perspective. By conducting thorough research

Find Us

Add.: Ward No 2, Near Mahakaal School,

Purani Basti, Maihar, Satna, MP

Support Mobile No.: +91-8269981108

Email: support@therapidinvestors.com

Contact details Of Principle Officer:

info@therapidinvestors.com

Compliance Officer: Shubham Sharma

Contact No.: +91-8269981108

Email: support@therapidinvestors.com

therapidinvestors@gmail.com

Copyright © 2023 The Rapid Investors – Developed & Design By Jinpushp Infotech

WhatsApp us