Primium Index Option

A premium index option is a type of derivative that allows investors to buy or sell an option on a broad market index, such as the S&P 500 or the Nasdaq, instead of on individual stocks. The “premium” here refers to the upfront cost paid by the buyer of the option to the seller, which gives them the right to buy (call option) or sell (put option) the index at a predetermined price, known as the strike price, before a specified expiration date. Premium index options are popular among investors looking for exposure to market trends or those who want to hedge their portfolios against potential market downturns.

One key advantage of premium index options is their broad market exposure. Unlike individual stock options, which are affected by company-specific events, index options are influenced by the overall performance of a market sector or the economy. This can provide investors with a less volatile investment, as market indexes tend to be more stable than individual stocks. Additionally, premium index options allow investors to gain exposure to a diversified basket of assets without having to directly buy each stock in the index, which can reduce transaction costs and simplify portfolio management.

The premium paid for an index option is influenced by various factors, including the time remaining until expiration, the current level of the index relative to the strike price, and the expected volatility of the market. For example, if market volatility is high, the premium for the option may increase, as there is a higher probability of significant price movements. Time decay also plays a role; as the expiration date approaches, the option’s value typically decreases if it’s out of the money, as there’s less time for the index price to reach the strike price.

Investors often use premium index options for both speculative and hedging purposes. Speculators might buy call options on an index if they believe the market will rise, while they might buy put options if they anticipate a decline. On the other hand, investors with existing portfolios might use put options as insurance, ensuring some protection if the market falls significantly. This flexibility makes premium index options a valuable tool for various market strategies, helping investors manage risk while potentially capturing upside in a cost-effective way.

Primium Index Option

A premium index option is a financial derivative that gives the holder the right, but not the obligation, to buy or sell a stock index at a specified premium price before a set expiration date.

Risk & Rewards

Will be better than 1:2

Our services features & what we serve to our clients.

- 1. Expected number of quality recommendations is 20-22 per month.

- 2. We will provide stop loss and target with regular followup.

- 3. Minimum capital requirement – 50,000 INR to 2,00,000 INR.

- 1. Timely Global market and Economic data update.

- 2. Method – Technical breakout with volume and price level.

- 3. Customer support – 9:00 AM to 6:30 PM (Mon – Sat).

- 1. All important news and economy updates.

- 2. Proper follow up through SMS.

- 3. Complete Resistance & Support on daily basis.

- 4. All Segment Calls from NISM Certified.

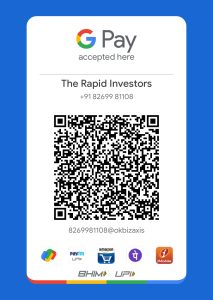

The Rapid Investors

important to approach it with caution and a long-term perspective. By conducting thorough research

Find Us

Add.: Ward No 2, Near Mahakaal School,

Purani Basti, Maihar, Satna, MP

Support Mobile No.: +91-8269981108

Email: support@therapidinvestors.com

Contact details Of Principle Officer:

info@therapidinvestors.com

Compliance Officer: Shubham Sharma

Contact No.: +91-8269981108

Email: support@therapidinvestors.com

therapidinvestors@gmail.com

Copyright © 2023 The Rapid Investors – Developed & Design By Jinpushp Infotech

WhatsApp us