TRI Combo Option

The TRI Combo Option in the stock market is a type of investment strategy involving options. It typically refers to a position that combines both “call” and “put” options on the same underlying stock or index to create a hedged or strategic position. This approach is frequently used by investors and traders to take advantage of specific market conditions, reduce risk, or speculate on price movement with limited loss potential. Here’s a closer look:

TRI Combo Option Structure

In an Apex Combo Option, you may create either:

1. **Straddle**: Buying both a call and a put option with the same strike price and expiration date.

2. **Strangle**: Buying both a call and a put with the same expiration date but different strike prices.

3. **Iron Condor**: A four-option strategy with both calls and puts, which has a limited profit range.

Each of these approaches has different cost structures, risk profiles, and payoff potential. Apex Combos generally involve combining these positions based on the expected volatility of the stock or market.

—

Pros of TRI Combo Options

1. **Risk Management**:

– Apex Combos can help limit losses due to their balanced risk and return structure, especially in volatile markets.

2. **Flexibility**:

– They provide opportunities to gain from both upward and downward price movements, making them versatile.

3. **Limited Downside**:

– Some combos, like straddles, are designed to cap losses in case of adverse price movements.

4. **Potential High Gains on Volatility**:

– If there’s a major price movement, these combos allow for profitable outcomes as gains from one option (call or put) offset the other.

5. **Income Potential**:

– Iron Condors and similar combos allow investors to earn premiums by writing options while limiting risks.

—

### Cons of Apex Combo Options

1. **Complexity**:

– Requires a solid understanding of options, and without that knowledge, it can be difficult to execute successfully.

2. **High Initial Cost**:

– Combos often involve multiple options contracts, which increases initial investment costs.

3. **Market Volatility Dependence**:

– Strategies like the straddle are only profitable if there’s high volatility. If the stock price doesn’t move much, both options could lose money.

4. **Risk of Loss**:

– Losses, though limited, are still possible, especially in cases where the stock doesn’t move as predicted or volatility remains low.

5. **Fees and Commissions**:

– Higher transaction costs due to the number of options involved.

Apex Combo Options can be a valuable strategy, but they require an understanding of market behavior, solid risk management, and careful monitoring due to their sensitivity to volatility and price movements.

Risk & Rewards

Will be better than 1:3

Our services features & what we serve to our clients.

- 1. Expected number of quality recommendations is 25-30 per month.

- 2. We will provide stop loss and target with regular followup.

- 3. Minimum capital requirement – 50,000 INR to 2,00,000 INR.

- 1. Timely Global market and Economic data update.

- 2. Method – Technical breakout with volume and price level.

- 3. Customer support – 9:00 AM to 6:30 PM (Mon – Sat).

- 1. All important news and economy updates.

- 2. Proper follow up through SMS.

- 3. Complete Resistance & Support on daily basis.

- 4. All Segment Calls from NISM Certified.

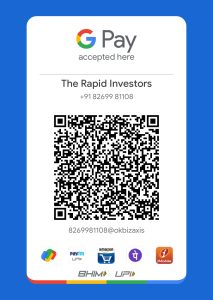

The Rapid Investors

important to approach it with caution and a long-term perspective. By conducting thorough research

Find Us

Add.: Ward No 2, Near Mahakaal School,

Purani Basti, Maihar, Satna, MP

Support Mobile No.: +91-8269981108

Email: support@therapidinvestors.com

Contact details Of Principle Officer:

info@therapidinvestors.com

Compliance Officer: Shubham Sharma

Contact No.: +91-8269981108

Email: support@therapidinvestors.com

therapidinvestors@gmail.com

Copyright © 2023 The Rapid Investors – Developed & Design By Jinpushp Infotech

WhatsApp us